General Liability and Professional Liability insurance are two distinct types of coverage that protect businesses from different kinds of risks. While both are essential in managing liabilities, they each cover specific areas of potential exposure. Here’s a breakdown of what each type covers and why they are important.

General Liability Insurance

General Liability Insurance (also called Commercial General Liability or CGL) protects a business from third-party claims of bodily injury, property damage, personal injury, and advertising injury that occur as a result of the business's operations, products, or premises.

What General Liability Covers

Bodily Injury:

Covers medical expenses, legal fees, and settlements if a non-employee is injured on the business’s property or as a result of the business’s operations. For example, if a customer slips and falls in a retail store, general liability would cover the related costs.

Property Damage:

Covers damages to someone else’s property caused by the business or its employees. For example, if a contractor accidentally damages a client’s property while working, general liability would help cover repair costs.

Personal and Advertising Injury:

Covers claims related to personal injury (such as defamation, slander, or invasion of privacy) and advertising injury (such as copyright infringement or misleading advertising).

Why General Liability Is Important

Broad Protection: General liability is essential for most businesses, as it covers common risks that can happen on business premises or during business activities.

Compliance: Many landlords, clients, and regulatory bodies require general liability insurance for businesses to operate or lease space.

Peace of Mind: This coverage allows businesses to handle accidents and injuries involving third parties without absorbing huge financial losses.

Professional Liability Insurance

Professional Liability Insurance (also known as Errors and Omissions or E&O Insurance) protects businesses against claims of negligence, errors, omissions, or failure to perform professional services. This insurance is especially relevant for professionals who provide advice, expertise, or services.

What Professional Liability Covers

Negligence Claims:

Covers claims related to errors, omissions, or failure to perform professional duties that lead to financial harm to a client. For example, if a financial advisor provides incorrect advice that results in a financial loss for a client, professional liability would cover the legal costs and any settlements or judgments.

Misrepresentation and Mistakes:

Covers claims of misrepresentation, poor advice, or unintentional mistakes made during professional services. For example, if an architect makes a design error that leads to additional construction costs, professional liability would cover the resulting claim.

Breach of Contract (in some cases):

Some policies may cover claims of breach of contract, particularly if it’s related to a failure to meet professional obligations. However, this depends on the specific policy terms and is not always included.

Why Professional Liability Is Important

Specialized Coverage: Professional liability is tailored to the unique risks that come from providing professional services, where errors can result in financial harm or reputational damage.

Industry Requirement: Many industries (e.g., medical, legal, consulting, and financial services) require professional liability insurance due to the high risk of claims related to professional services.

Protects Reputation and Financial Stability: Professional liability insurance helps protect against costly lawsuits that could damage a professional’s reputation and financial standing.

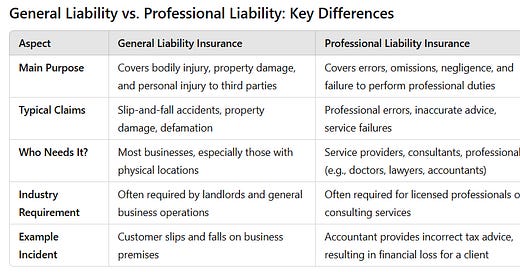

General Liability vs. Professional Liability: Key Differences

AspectGeneral Liability InsuranceProfessional Liability InsuranceMain PurposeCovers bodily injury, property damage, and personal injury to third partiesCovers errors, omissions, negligence, and failure to perform professional dutiesTypical ClaimsSlip-and-fall accidents, property damage, defamationProfessional errors, inaccurate advice, service failuresWho Needs It?Most businesses, especially those with physical locationsService providers, consultants, professionals (e.g., doctors, lawyers, accountants)Industry RequirementOften required by landlords and general business operationsOften required for licensed professionals or consulting servicesExample IncidentCustomer slips and falls on business premisesAccountant provides incorrect tax advice, resulting in financial loss for a client

Why Businesses Often Need Both

Many businesses require both General Liability and Professional Liability insurance, especially if they offer services and interact with clients or customers in person. Here’s why:

Coverage Gaps: General liability policies don’t cover professional errors or negligence. If a business provides both tangible products/services and professional advice, both policies may be necessary to ensure comprehensive protection.

Meeting Contractual Obligations: Contracts with clients or landlords may require specific coverage types, and some clients expect their vendors or consultants to carry both general and professional liability insurance.

Broader Risk Management: With both coverages, businesses are protected against a wide array of risks, from physical accidents on premises to errors in professional advice or service.

Example of Combined Coverage Need

A marketing consultant might need both coverages because:

General Liability would cover bodily injury if a client slipped and fell during an in-person meeting at their office.

Professional Liability would cover claims if the client alleges financial loss due to poor marketing advice.

In summary, General Liability Insurance covers common risks related to third-party injuries and property damage, while Professional Liability Insurance covers risks associated with professional services and advice. Together, they provide comprehensive protection for businesses facing both general operational and specialized professional risks.