Conducting a Commercial Insurance Coverage Audit is a thorough review of a business’s current insurance policies to identify any gaps, overlaps, or areas where coverage may need to be adjusted. This audit helps ensure that the business has adequate protection for its unique risks and is not overpaying for redundant or unnecessary coverage. Here’s a step-by-step guide for a comprehensive commercial insurance coverage audit:

Commercial Insurance Coverage Audit

Business Name:

Date:

Person Responsible for Audit:

1. Identify Current Policies and Coverage

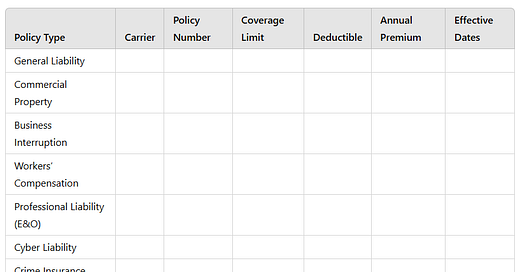

List all existing policies with key details, including policy numbers, effective and expiration dates, and insurance carriers.

Document coverage limits, deductibles, premiums, and any specific terms or conditions.

Policy TypeCarrierPolicy NumberCoverage LimitDeductibleAnnual PremiumEffective DatesGeneral LiabilityCommercial PropertyBusiness InterruptionWorkers’ CompensationProfessional Liability (E&O)Cyber LiabilityCrime InsuranceInland MarineCommercial AutoUmbrella/Excess Liability

2. Review Policy Terms and Conditions

Coverage Limits: Confirm that coverage limits align with the business’s needs and risks. If assets, operations, or revenue have grown, consider increasing limits.

Deductibles: Evaluate deductibles to ensure they are affordable in the event of a claim. Higher deductibles reduce premiums but may pose a financial burden if a claim occurs.

Policy Exclusions: Note any exclusions and limitations that could leave the business exposed. Exclusions are often listed in policy details and may vary widely by policy type.

3. Evaluate Coverage Types and Identify Gaps

General Liability: Confirm coverage for bodily injury, property damage, personal injury, and advertising injury. Consider if higher limits are needed based on business activities.

Commercial Property: Ensure coverage for buildings, contents, and equipment at replacement value. Verify if coverage includes specific risks, like natural disasters, if applicable.

Business Interruption: Ensure coverage includes sufficient limits for lost revenue, operating expenses, and payroll during shutdowns. Check if it includes utility and extra expense coverage.

Workers’ Compensation: Review compliance with state requirements and verify that employee classifications and payroll estimates are accurate to avoid penalties.

Professional Liability (E&O): Review coverage for errors, omissions, and negligence if the business provides professional services. Check for potential exclusions related to the business's specific industry.

Cyber Liability: Confirm coverage for data breaches, cyber extortion, and business interruption due to cyber incidents, especially if the business relies on sensitive data or operates online.

Crime Insurance: Ensure coverage for employee dishonesty, theft, and fraud. Evaluate if social engineering and electronic theft coverage is needed.

Inland Marine: Assess the need for inland marine coverage for property that moves between locations or is regularly off-premises.

Commercial Auto: Verify that all business-owned and leased vehicles are listed, and confirm coverage for hired and non-owned vehicles if employees drive personal cars for business.

Umbrella/Excess Liability: Review limits of umbrella coverage to determine if additional layers are necessary to cover high-cost claims across liability policies.

4. Assess Additional Needs Based on Business Operations

Employment Practices Liability Insurance (EPLI): Consider if EPLI is needed for protection against claims of wrongful termination, harassment, discrimination, or retaliation.

Directors and Officers (D&O) Insurance: Determine if D&O coverage is necessary to protect executives and board members from claims related to their decisions and management.

Environmental Liability Insurance: Assess if the business faces environmental exposures requiring coverage for pollution-related claims.

Product Liability Insurance: For businesses involved in manufacturing, distributing, or retailing products, evaluate the need for product liability coverage against claims of defective or unsafe products.

5. Examine Loss History and Risk Exposures

Loss Runs and Claims History: Obtain loss runs for the past 3–5 years to identify trends in claims frequency and severity. Frequent claims may indicate areas where additional risk management or coverage adjustments are needed.

Risk Exposure Analysis: Consider the business’s primary risks (e.g., fire hazards, cyber threats, physical injury risks) and assess if existing policies provide adequate protection.

Implement Risk Management Programs: Identify risk management practices that can reduce claims (e.g., employee safety training, cybersecurity improvements) and potentially lower insurance premiums.

6. Analyze Premium Costs and Explore Options

Compare Quotes: Contact other insurers or brokers for competitive quotes on policies that have had premium increases, but ensure they meet the business’s coverage needs.

Bundling Options: Explore options to bundle policies (e.g., BOP for small businesses) to reduce premiums and simplify management.

Review Discounts: Ask insurers about discounts for implementing risk management programs, installing safety equipment, or meeting safety certifications.

7. Summarize Findings and Recommendations

Coverage Gaps: Summarize any gaps in coverage identified during the audit (e.g., insufficient cyber liability limits, lack of EPLI coverage).

Overlaps: Identify any overlapping coverages that may lead to redundant costs (e.g., double coverage on certain equipment).

Recommended Adjustments:

Increase or decrease limits based on the business’s growth and risk profile.

Add new coverages where necessary (e.g., cyber liability, EPLI).

Consider deductible adjustments for more favorable premium costs.

Enhance risk management practices to reduce claims and improve premium rates.

8. Create an Action Plan for Implementation

Prioritize Coverage Adjustments: Rank necessary adjustments based on urgency and impact on risk.

Communicate with Insurance Provider: Contact the insurer to discuss recommended changes, negotiate rates, and request policy modifications as needed.

Schedule Regular Audits: Set up a timeline for annual or semi-annual audits to keep coverage aligned with business needs as the business grows and changes.

Final Remarks

Conducting a commercial insurance audit helps ensure that the business is adequately protected without overpaying for unnecessary coverage. This audit should be reviewed with an insurance professional or broker to ensure all recommendations align with the business's needs and risk tolerance. Regular audits help maintain appropriate coverage, manage risks effectively, and provide peace of mind.